In this post we take a closer look at the management of low-complexity claims and how digital reduces claims costs, while enhancing policyholder satisfaction.

In any claims process, the insurer faces multiple challenges: reducing the claims costs, compliance with regulations and keeping the customer – the policyholder – happy. As a 2014 survey into the importance of claims services by Accenture showed, the two most important customer satisfaction drivers – aside from the perceived fairness of the settlement – are speed of settlement and transparency of the claims process.

Increased productivity

A high level of automation will reduce the costs thanks to improved productivity. Less complex claims are settled automatically if they fall below a pre-defined threshold and no fraud indicators are present. Straight-through-processing, customary for handling windscreen claims, is the ultimate streamlined process. The insurer’s preferred vehicle glass repair and replacement company uses the insurer’s portal to enter the claim and policy details. The glass is repaired or replaced on the spot with policy excess and reporting all being dealt with automatically.

Straight-through processing

The 2016 EY e-book ‘The future of claims’ confirms our findings that customers are increasingly willing to handle less complex claims entirely through digital channels. Straight-through-processing clearly shows potential for different types of low-value, high frequency losses, particularly in personal lines such as travel and household claims. Though fully automated, the process could embrace a high level of customer engagement through online self-service and immediate satisfaction.

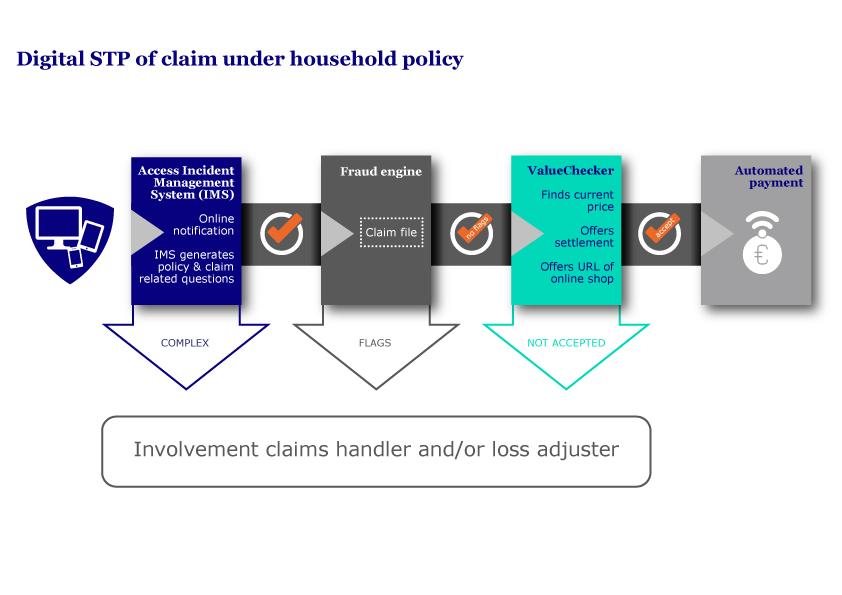

The following process shows the potential of straight through processing of household claims, securing in all phases the potential of manual intervention by a claims handler if and when necessary.

The process explained

In this process the policyholder notifies the claim using his or her preferred device and the insurer’s online portal. This portal, the Incident Management System, generates questions based on policy and claim data entered by the policyholder. Having automatically established cover under the policy, low-complexity claims are checked by the fraud engine. Subsequently, the value of the damaged, lost or stolen items can be determined, using a system like ValueChecker. ValueChecker is an aggregator that searches all online shops and compares prices and product information. The lowest available price is selected, the applicable policy excess is deducted and settlement is offered, upon which payment can be made. In case the item is no longer available, a suitable replacement can be selected based on the product information.

Policyholders who prefer to call their insurer to notify a claim won’t notice it, but the desk claims handler can use this process in exactly the same way to achieve one-call completion: instead of the policyholder, the claims handler enters the details in the Incident Management System.

More complex claims too offer potential for customer involvement, especially for more tech-savvy customers. In our next contribution, we will show how mobile-based technology engages policyholders in the actual inspection of damage to their homes.

References:

Accenture (2014). The Digital Insurer Claims Customer Survey: Why claims service matters

EY (2016). The future of claims.